Lagos, Nigeria — Renowned economist Gbolahan Olojede has cautioned that the Federal Government’s proposed 15 per cent import duty on petroleum products could reignite inflationary pressures and further strain Nigerian consumers already grappling with high living costs.

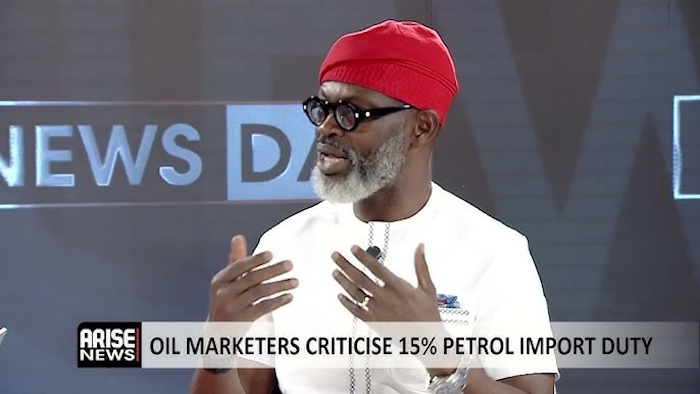

Speaking during an interview with ARISE News on Tuesday, Olojede said that while the policy’s intention — to protect local industries and encourage domestic refining — is understandable, the government must adopt a transparent and data-driven approach to avoid unintended economic consequences.

“On the face of it, the idea is to protect local industry and create jobs. But the level of transparency in that industry remains a problem,” he said.

Questions Over Local Refining Costs

Olojede questioned why local refineries were not producing fuel at competitive prices despite earlier government assurances that domestic refining would reduce costs.

“The original goal was to make things cheaper — no importation, no freight, no forex charges. So why is local refining now more expensive?” he asked.

He added that if local producers were offering higher-quality fuel, such information should be clearly communicated to consumers.

“If the refinery produces superior fuel, consumers deserve the choice to pay more for quality. But there’s no transparency around that yet,” he stated.

Inflation and Consumer Impact

Olojede warned that the 15 per cent import duty would directly translate into higher petrol prices, as importers would pass on additional costs to consumers.

“Fifteen per cent means roughly a 15 per cent price increase. Importers will shift that burden to consumers already recovering from the last hike,” he said.

He cautioned that the move could reverse recent progress in stabilizing inflation, which had improved due to lower energy costs earlier in 2025.

“If we raise costs again now, we risk undoing the gains made. Even if the policy is necessary, we should wait for more stability,” Olojede advised.

Broader Fiscal Concerns

Addressing Nigeria’s low tax-to-GDP ratio, Olojede agreed that the government must boost revenue but stressed the need for fiscal fairness and accountability.

“Citizens feel overtaxed because they can’t distinguish taxation from extortion. They pay money that doesn’t reach the government,” he said.

He expressed optimism that the new tax law could improve tax equity, provided there is strong political will.

“Middle-class Nigerians bear the brunt of taxation while top earners often evade taxes. The more you gain from the economy, the more you should contribute,” he added.

Smuggling and Border Challenges

Olojede also warned that the proposed duty could encourage smuggling if efficiency at ports and borders is not improved.

“Every time you raise official costs, people find shortcuts. Unless port operations become faster and more transparent, smuggling will thrive,” he said, adding that Nigeria’s porous northern borders remain a significant risk.

He commended the Interior Minister’s efforts to strengthen border reforms but urged for a more coordinated national strategy.

Call for Balanced Policy

Concluding, Olojede urged the government to pursue fiscal reforms with empathy and accountability.

“We must move toward sustainability, but with transparency and sensitivity to people’s realities. Nigerians are still recovering; don’t burden them further until the system is ready,” he said.