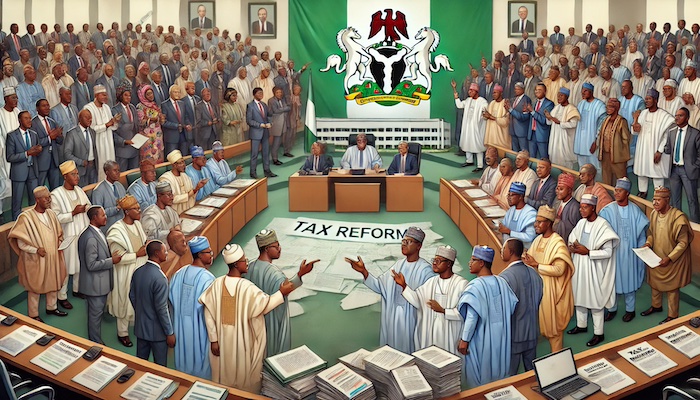

In a major move toward reshaping Nigeria’s fiscal architecture, the National Assembly has transmitted four critical tax reform bills to President Bola Tinubu for assent—marking a decisive step in advancing the administration’s Renewed Hope economic agenda.

Senator Yemi Adaramodu, Chairman of the Senate Committee on Media and Public Affairs, confirmed the transmission during a press briefing at the National Assembly on Tuesday. He noted that both chambers had successfully harmonized the legislative texts, culminating in their final endorsement.

“The bill has now been transmitted. It is out of our hands and on its way to the executive,” Adaramodu stated.

The legislative package includes the Joint Revenue Board (Establishment) Bill, Nigeria Revenue Service (Establishment) Bill, Nigeria Tax Administration Bill, and the Nigeria Tax Bill. Together, these reforms aim to overhaul tax collection systems, broaden the national tax base, reduce administrative inefficiencies, and improve intergovernmental revenue coordination.

Originally submitted in November 2024, the bills faced rigorous scrutiny, revisions, and prolonged negotiations to ensure alignment with Nigeria’s existing legal and fiscal frameworks. Adaramodu emphasized the importance of legal vetting and collaboration between both chambers’ committees and legal units.

The harmonized documents were signed by both Senate President Godswill Akpabio and House Speaker Tajudeen Abbas before being sent to the Presidency for final approval.

Akpabio hailed the bills as a product of “national interest, inclusive legislative engagement, and strategic leadership.” He also acknowledged the contentious debates over fiscal provisions, particularly a proposal that would have allowed states to retain 60% of collected Value Added Tax (VAT). That clause met stiff resistance, especially from Northern lawmakers concerned about regional disparities.

A compromise was eventually reached, lowering the retention rate to 30% and replacing the term “derivation” with “place of consumption” to ensure a more equitable distribution.

Despite opposition from some governors and internal legislative divisions, the final framework was accepted in the spirit of national unity. Akpabio commended state governors for embracing the revised version and praised Speaker Abbas for rallying younger lawmakers around the reform.

“If signed into law, these bills will usher in the most transformative tax and revenue overhaul in Nigeria’s recent history,” Adaramodu said. The new laws are expected to enhance fiscal federalism, streamline oversight, and plug long-standing revenue leakages that have hindered national development.