Abuja, Nigeria – May 21, 2025 | The Central Bank of Nigeria (CBN) has maintained the Monetary Policy Rate (MPR) at 27.50%, signaling a wait-and-see approach amid signs of macroeconomic stability and declining inflation.

After its 300th Monetary Policy Committee (MPC) meeting on Tuesday, the apex bank also retained key policy parameters:

-

Asymmetric corridor at +500/-100 basis points

-

Cash Reserve Ratio at 50% for Deposit Money Banks and 16% for Merchant Banks

-

Liquidity Ratio at 30%

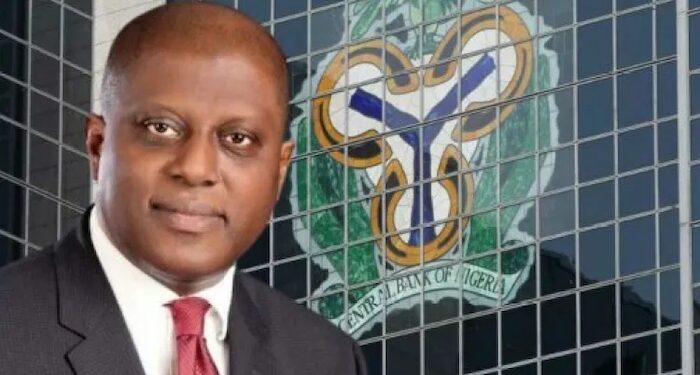

Addressing the media, CBN Governor Olayemi Cardoso said the decision to hold was unanimous, citing improvements in macroeconomic indicators, particularly the easing of inflation and stabilization of the foreign exchange market.

“The overall trajectory is in the right direction. Not one aspect of managing the economy is a silver bullet—it is a combination of consistent policy efforts,” Cardoso stated.

Inflation Declines in April

According to figures from the National Bureau of Statistics (NBS), Nigeria’s headline inflation eased to 23.71% in April 2025, down from 24.23% in March. On a month-on-month basis, inflation declined to 1.86%, compared to 3.9% in March.

-

Food inflation dropped to 21.26% in April from 21.79% in March

-

Core inflation fell to 23.39%, down from 24.43%

Cardoso attributed the improvements to government interventions to boost food supply and enhance security in farming communities.

Foreign Exchange Market and External Reserves Improve

Cardoso highlighted the narrowing gap between the Nigerian Foreign Exchange Market (NFEM) and Bureau De Change (BDC) rates, noting a decline in FX volatility.

He disclosed that gross external reserves rose by 2.85% to $38.90 billion as of May 16, 2025, representing an import cover of 7.6 months. The Balance of Payments (BOP) also recorded a surplus of $1.10 billion in Q4 2024, despite a moderation in the current account.

“Volatility in the FX market has declined from over 4% to below 0.5%, which reflects growing confidence,” said the CBN chief.

Banking System Stable Amid Recapitalization Efforts

The MPC reaffirmed the stability of the Nigerian banking sector, citing strengthening performance indicators and progress in ongoing recapitalization initiatives. The committee urged continued regulatory vigilance to maintain industry health.

Policy Support for Investment and Economic Growth

Addressing concerns over perceived delays in tangible benefits from macroeconomic reforms, Cardoso emphasized that investor confidence is gradually returning.

“Investors don’t go where there’s instability. Now that the Nigerian economy is stable, investor interest is increasing—and with investment comes growth,” he said.

He also highlighted Nigeria’s relative success in managing currency depreciation amid global shocks, stating, “Our devaluation has been modest compared to many economies. Early reform measures helped us build buffers.”

Global Outlook and Domestic Strategy

Cardoso noted that the International Monetary Fund (IMF) had downgraded global growth projections to 2.8% for 2025 and 3.0% for 2026, down from 3.3% in 2024, due to persistent global uncertainty.

He acknowledged that inflationary pressures remain, fueled by electricity costs, foreign exchange demand, and legacy structural challenges, but emphasized that both fiscal and monetary authorities are coordinating to sustain stability.

“The MPC reaffirmed its commitment to anchor inflation expectations and ease exchange rate pressure,” Cardoso concluded.

KEY TAKEAWAYS

-

MPR unchanged at 27.50%

-

Headline inflation down to 23.71% in April 2025

-

FX reserves up to $38.90 billion

-

Inflation, FX stability attributed to reforms

-

Banking sector remains stable and well-capitalized

-

Naira depreciation moderate despite global shocks