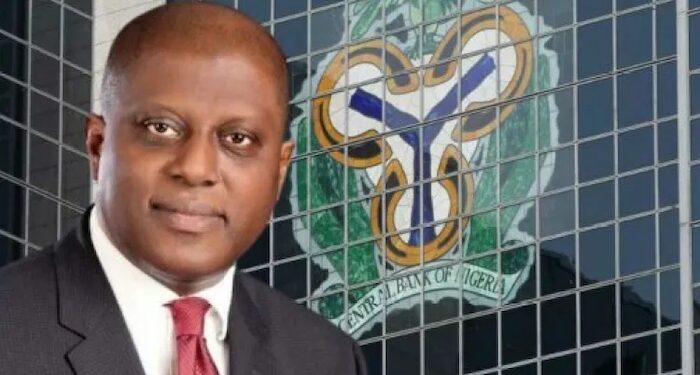

Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, has emphasized the need for stronger economic relations with the Middle East, particularly with the Nigerian diaspora in the region. Speaking during a meeting with Talal Al-Humond, Assistant Governor for Monetary Affairs at Saudi Arabia’s Central Bank (SAMA), Cardoso highlighted the potential for enhanced cooperation during the inaugural Conference on Emerging Markets Economies held in Riyadh from February 16 to 17.

Cardoso stressed the importance of learning from Saudi Arabia’s successful infrastructural and tourism projects, particularly its efforts to diversify its economy. He reaffirmed his commitment to leveraging Nigeria’s diaspora to boost remittance flows and strengthen the country’s financial sector.

Commitment to Youth Empowerment and Economic Reforms

At the same time, Nigeria’s Minister of Finance, Mr. Wale Edun, reiterated the government’s dedication to empowering the nation’s youth, particularly in critical sectors such as agriculture, manufacturing, and exports. Edun made the statement during a meeting with the Arewa Youth Forum (AYF) in Abuja, where he assured the group that the government was committed to breaking down barriers to youth participation in the economy.

Additionally, the Manufacturers Association of Nigeria (MAN) raised concerns over the high lending rates charged by commercial banks, which stood between 35% and 48% in the last quarter of 2024, according to the Manufacturers CEO Confidence Index (MCCI).

Nigeria’s Financial Reforms and Economic Outlook

During the conference, Cardoso shared details of Nigeria’s significant reforms in the financial sector, particularly in the foreign exchange market. He highlighted that under his leadership, the gap between the official and parallel market exchange rates had narrowed from as much as 60% to around 4-5%. This shift followed the introduction of an electronic matching system for forex transactions and a foreign exchange code of ethics that was signed by Nigerian banks.

Cardoso also discussed the elimination of fuel subsidies, a move that had previously cost Nigeria about 6% of its GDP annually. This decision, along with other reforms, has been pivotal in improving the country’s fiscal outlook. He emphasized that these reforms were necessary to restore macroeconomic discipline and build a resilient financial system.

In terms of financial sector stability, the CBN governor stated that Nigerian banks had been mandated to recapitalize, strengthening the sector to withstand future economic shocks. He also noted that Nigeria’s foreign reserves had reached over $40 billion, the highest in nearly three years.

Digitalization and Financial Inclusion for Sustainable Growth

Cardoso also underscored the role of digitalization in advancing financial inclusion, citing that Nigeria’s financial inclusion rate currently stands at 74%. He called for aggressive efforts to expand this number, ensuring that economic growth reaches all segments of society, particularly underserved populations, including women. He highlighted the government’s focus on using mobile money and technology to enhance financial access, which would close the gap and foster more inclusive economic growth.

Government Initiatives to Support Youth Empowerment

Edun outlined several initiatives aimed at increasing youth participation in Nigeria’s economy. These include the Student Loan Programme, which has benefited over 100,000 students with an allocation of N30 billion, as well as the Digital and Creative Economy Fund, which supports youth-led businesses, especially those led by women entrepreneurs. Furthermore, the Consumer Credit Access initiative is designed to improve financial access for young Nigerians, further promoting youth empowerment.

The finance minister expressed the federal government’s commitment to a vibrant and sustainable economy, noting that the Tinubu administration remains focused on fostering inclusive growth.