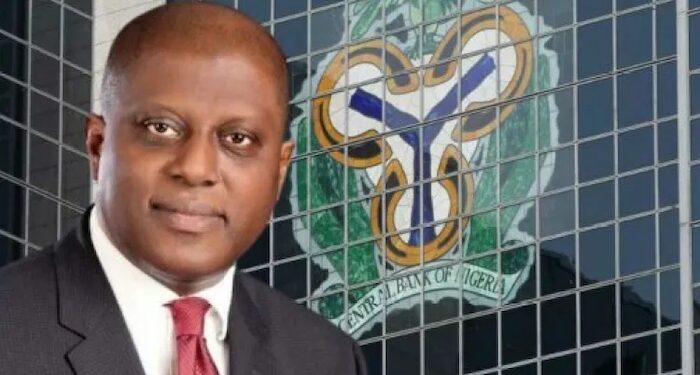

In a bid to tackle the persistent cash scarcity in Nigeria, the Central Bank of Nigeria (CBN) has announced plans to inject N1.4 trillion into the economy over the next three months. CBN Governor Olayemi Cardoso made the announcement on Tuesday during a press conference in Abuja, reiterating the bank’s commitment to ensuring sufficient cash availability.

“There is no excuse for not having sufficient cash in the system,” said Cardoso, adding that deposit money banks would be held accountable for any failure to dispense cash adequately through their ATMs.

Strengthening Cash Circulation and Bank Accountability

The move comes as part of a broader effort to improve liquidity within the banking system, with the CBN closely monitoring compliance. Cardoso revealed that a strict monitoring system has been put in place to assess how banks manage cash distribution, warning that any institution found non-compliant would face sanctions.

“We have devised a monitoring system to ensure that banks are adhering to the prescribed guidelines. Any non-compliance will result in sanctions,” Cardoso stated.

History of Cash Scarcity and Mitigation Efforts

Cash scarcity has been a recurring issue in Nigeria, especially since November 2023, when a surge in withdrawals overwhelmed the banking system. Despite the CBN’s assurance of sufficient currency in circulation, shortages persisted. In December, the CBN attributed the scarcity to widespread hoarding by individuals.

To ease the pressure, commercial banks have imposed withdrawal limits on ATMs, further restricting cash access for customers. Cardoso’s recent announcement signals a renewed effort by the CBN to address these challenges and restore confidence in Nigeria’s financial system.