Since 2004 when the former governor of the Central Bank of Nigeria (CBN), Professor Charles Soludo, carried out reforms of Nigeria’s financial infrastructure, the system has grown in leaps and bounds. The reforms have dramatically transformed the banking landscape from an unfit-for-purpose financial system with 89 fragile banks that could neither support the economic transformation of the country through private sector-driven initiatives nor compete with foreign banks into (22 as of now) bigger and stronger banks. According to Soludo, “Confidence in the system was very low. All the banks put together were smaller than the fourth-largest bank in South Africa, and none of them was in the top 1,000 banks in the world. If any private sector entity needed a loan of US$500m, it had to syndicate it from all the banks put together – or go abroad.”

Nigeria’s total banking sector assets amounted to less than 20% of GDP at the time, and bank loans were about 4% of the country’s GDP. “Talk about a private sector-led economy was simply a slogan, as there was no financial system to power that,” continued Soludo. “We concluded that the system needed to be brought down and recreated from scratch….. Nigeria had never experienced a policy revolution of that magnitude”, he told Lawrie Holmes of Public Finance International in 2012.

From that pathetic pre-reform situation, the banking system has witnessed a massive turnaround to a very robust, strong, versatile system that now finances multi-billion dollar private sector projects. Dangote Group’s massive expansion and growth are owed partly to capital financing by our local banks; something previously impossible pre-consolidation. Some of the banks are now so big and have gone global that anything that smells of corporate greed, incompetence or scandal can wreck the system very quickly. The revolution and evolution have been truly phenomenal.

But the gains of that consolidation that have put several Nigerian banks among the top 500 in the world are in danger of unravelling as a result of heavy-handed regulatory interference and broader considerations beyond pure business imperatives.

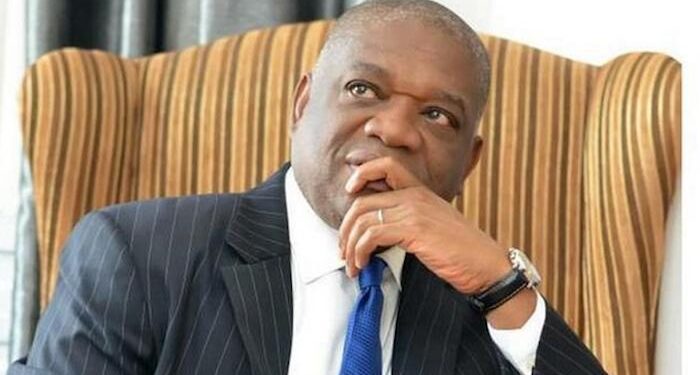

The agencies that investigated and are enforcing the outcome of the Orji Kalu case have hurt the dispassionate outcome of it by introducing into the enforcement process an interpretation outside the judgment of the court that goes against the grain of professional governance and regulatory administration. Indeed, the manner of enforcement of the court judgment against Kalu could easily hurt the steadily repaired reputation of Nigeria’s business environment and the Ease of Doing Business. The recent interrogation of the Managing Director of Access Bank by the Economic and Financial Crimes Commission (EFCC) over a dispute concerning the conviction of the former Abia State Governor, Orji Kalu and the winding-up order against his company, Slok Holding, is yet another disturbing development in the series of misadventures by investigative authorities.

Available information seems to suggest that the defunct Diamond Bank, which merged with Access Bank last year, financed the acquisition of 3 vessels by Slok with depositors’ funds amounting to $85m. The vessels, it is understood, have a long-term contract with Mobil Producing.

Last December, Orji Kalu, the principal shareholder of Slok, was convicted by a Federal High Court in Lagos of corruption and stealing of Abia State money and sentenced to 12 years in prison while his company, Slok, was ordered to be wound up and its assets forfeited to the government. The conviction was a commendable job done by the EFCC, no doubt.

But fellow Nigerians, does it make sense that the agency, which prosecuted Kalu, should now confiscate the vessels that were financed by Diamond Bank (now Access Bank by virtue of the 2019 merger)? In a real sense, are the vessels a part of the assets of Slok Holding when huge depositors’ money loaned to Slok to acquire the vessels is unpaid? So when EFCC moved to take inventory of Slok’s assets, the understanding is that the bank attempted to explain to the anti-corruption agency that Slok has an obligation to Access Bank, now the creditor bank and that the vessels in question do not belong to Slok or Orji Kalu. The loan obtained by Slok was secured by the vessels and the Mobil contract. One doesn’t have to rack one’s brain to understand the underlying structure of the transaction. It is therefore difficult to understand the insistence of the anti-corruption agency to vitiate a valid commercial contract between private sector entities. By pursuing this approach to asset recovery, the agency would, inadvertently, be creating dangerous precedence capable of discouraging private investment by both local and foreign investors.

The obvious questions are, should the EFCC have its way, who will repay the depositors’ funds used to finance the acquisition of the vessels? Is this not another way of shortchanging the shareholders of the lending bank? The normal practice is that when a company is going into liquidation, all liabilities are factored in so that no one gets the short-end of the stick. What will EFCC do with the vessels? Sell them in compliance with the winding-up order and remit the money to the government when Slok’s financial obligation to Access Bank has not been met? The solution would be a learning moment and a defining point in the resolution of a commercial loan involving the company of a politically exposed person.

In an opinion piece in February last year titled, ‘Things Fall Apart, But is the President Aware?’, a former Chairman of Stanbic IBTC, Mr. Atedo Peterside had lamented the damaging effect of the actions of regulators and law enforcement agencies on businesses/investments and stated that it was beginning to undermine business confidence with the potential of scaring away investors. He said the biggest negative of Buharinomics was allowing hard-working but sometimes overzealous law enforcement officers to go after private sector businesses in a manner that could discourage investment. “The business community then takes fright and investors flee, thereby sending the economy into a tailspin”, he added.

In June 2019, the United Nations report, as published by Reuters, stated that Foreign Direct Investment into Nigeria, Africa’s top oil producer plunged by as much as 43 percent to $2 billion in 2018. The report cited two significant hindrances to investment in Nigeria, namely regulatory activities and harassment by security agencies. Following the publication of that report, Peterside took to twitter to once again vent his anger on Nigerian regulators and law enforcement agencies who appear too willing to shakedown top chief executives of companies over one form of regulatory infraction or the other with the following tweet: “Nigeria’s rogue regulators finally succeeded in chasing away Foreign Direct Investment, (FDI)? Ghana had more FDI in 2018 than in Nigeria. Rogue security agencies contributed also. Nigerians no longer wish to invest here either.”

The blame for the huge drop in FDI and investors’ apathy towards Nigeria was allegedly the result of the dispute between the government and South African telecom giant, MTN over repatriated profits. As a result, Banks HSBC and UBS both closed their representative offices in Nigeria in 2018. The situation was compounded by EFCC when it entered the political arena, accusing the HSBC of money laundering immediately the bank predicted that if President Muhammadu Buhari was returned to office, it would “stunt the economy.” EFCC had, apparently, for the optics, vowed not to “rest on its oars” till all the looted funds allegedly in possession of the bank were repatriated back to Nigeria.

For those who don’t know, HSBC is one of the largest banking and financial services organisations in the world. Its international network comprises around 7,500 offices in over 80 countries and territories in Europe, the Asia-Pacific region, the Americas, Africa and the Middle East. Its mere presence in Nigeria was a huge confidence booster for our economy, and to have the bank exit on the altar of politics, undermined the integrity of our system. Apart from the fact that it is a correspondent bank to many of the local banks, many of our country’s international transactions such as Euro bonds, are packaged jointly with it.

Again, in September 2018 after the CBN ordered Standard Chartered and three other lenders to repay $8.134bn for allegedly issuing irregular Certificates of Capital Importation on behalf of some offshore investors of MTN Nigeria Communications Limited, armed operatives of the Economic and Financial Crimes Commission (EFCC) stormed the headquarters of Standard Chartered Bank in Lagos during working hours, presumably to arrest Bola Adesola, the managing director of the bank in the full glare of the bank’s customers who were later escorted out of the premises by EFCC operatives. It was a strange move by the anti-graft agency. The bank confirmed it then that EFCC operatives indeed entered its head office building but left shortly afterwards as there was no reason for them to be there. It is saddening that straightforward commercial disputes between regulators and business institutions which could have been resolved without any fuss with the cooperation of the latter have degenerated into a public spectacle.

The EFCC, on its part, said that it never sanctioned any raid on the headquarters of Standard Chartered Bank in Lagos, adding that the act might have been carried out by overzealous personnel. The commission noted that it’s modus operandi when probing any transaction was to invite officials of financial institutions after discreet investigations and that it does not use strong-arm tactics. It added that what happened in Standard Chartered Bank was a breach “of the standard operating procedures of the commission, as it is not the style of the EFCC to openly raid the offices of banks and other financial institutions.” I remain unpersuaded by EFCC’s statement.

It is important to note that the investigative agency’s governance framework involving private enterprises should build credibility in the legal system and protect enterprises from avoidable reputational damage. Dramatic actions of anti-graft bodies could discourage the much-needed foreign direct investments (FDIs). In recent times Nigeria’s loss has benefited Ghana, which is in the midst of an oil and gas boom. With inflows of $3bn, it dethroned Nigeria and became West Africa’s leading destination for foreign investment.

To reverse the migration of the much-needed FDI across the borders, the Nigerian government and its crime-fighting agencies must take the processes of institutional governance in commercial matters more seriously and protect the integrity of the financial system and the credit management process. Forfeitures should protect those that provide loanable funds. The recent EFCC/Slok/Access Bank dispute could erode business confidence and stall the inflow of foreign investment capital into the economy. Rather than insist on seizing Slok’s contracted vessels and auctioning them off to third parties, EFCC should follow not only the letter but also, the spirit of the law. Open and frank discussions should commence with Access Bank towards finding an amicable solution to the matter in such a way that no party gets the short-end of the stick.

The Slok incident should serve as a learning moment for all parties and provide useful takeaways that will serve as a basis for due governance processes in future. For sure, the local and international business community is keenly watching as events unfold and would be deeply interested in how the tango ends. I’m watching with keen interest to see whether depositors’ funds will be protected.