The Central Bank of Nigeria (CBN) has reaffirmed the strength and stability of the nation’s banking sector as it guides select institutions through the final stages of regulatory forbearance. In a strategic move to ensure a smooth transition, the apex bank issued targeted directives to banks still adjusting from the temporary relief measures implemented during the COVID-19 era.

According to a statement released by Acting Director of Corporate Communications, Mrs. Hakama Sidi Ali, the transitional guidance aligns with the broader recapitalisation roadmap announced in 2023. The initiative is designed to bolster financial resilience, support sustainable economic growth, and align domestic banking practices with global standards.

Despite market anxieties, the CBN emphasized that these temporary measures only affect a limited number of banks. These directives include the suspension of dividend payouts, executive bonuses, and foreign investment ventures—allowing affected institutions to strengthen their capital buffers and meet risk-weighted asset thresholds.

“The Nigerian banking sector remains fundamentally sound,” the CBN stated. “These measures are standard practice and part of the sequenced implementation of ongoing reforms.”

As a result of market apprehension surrounding the guidance, the Nigerian equities market extended losses on Tuesday. The NGX All-Share Index dropped 0.30% to close at 114,910.16 points, while market capitalization declined by 0.25% to ₦72.50 trillion. Stocks of key banks—such as United Bank for Africa, Fidelity Bank, Access Corporation, and FIRSTHOLDCO—recorded notable declines, reflecting investor caution.

The CBN explained that the current policy aligns with global regulatory norms, drawing parallels with transitional measures adopted in the U.S., Europe, and other key markets. Nigerian international banks are currently required to maintain a Tier 1 capital ratio of 11.25%, nearly double the Basel III global minimum of 6%.

In a June 13 circular, signed by Director of Banking Supervision Dr. Olubukola Akinwunmi, the CBN directed all forbearance-status banks to halt dividend payments, executive bonuses, and offshore investments. This temporary restriction is aimed at ensuring full compliance with capital adequacy standards and risk provisioning.

The regulatory body stressed that these constraints will be lifted once banks meet the set conditions, exit the forbearance framework, and undergo independent verification of their financial metrics.

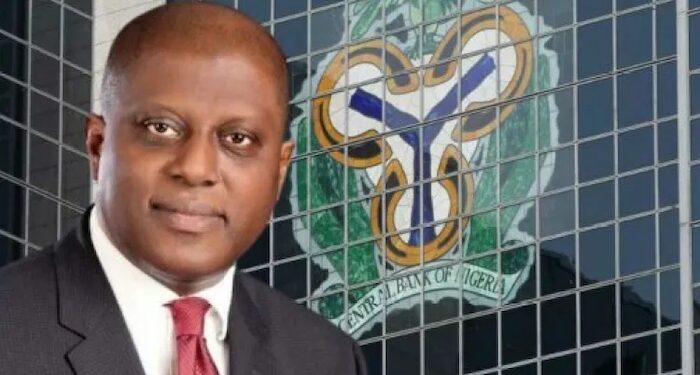

CBN Governor Olayemi Cardoso has maintained a no-extension stance on the forbearance deadline. Though the initial exit was slated for December 2024, banks were granted a final six-month window, set to expire in June 2025.

The CBN concluded by affirming its commitment to continuous stakeholder engagement and transparent regulatory oversight through channels like the Bankers’ Committee and the Body of Bank CEOs.

“These are not emergency interventions,” the bank reiterated, “but a continuation of deliberate reforms ensuring Nigeria’s financial system remains resilient and globally competitive.”