In response to escalating inflationary pressures, the Central Bank of Nigeria (CBN) has taken bold steps to tighten monetary policy. During its latest Monetary Policy Committee (MPC) meeting, the CBN announced significant adjustments, including raising the Monetary Policy Rate (MPR) by 400 basis points to 22.75 percent from 18.75 percent.

The CBN also expanded the asymmetric corridor around the MPR and increased the Cash Reserve Requirement (CRR) to 45 percent from 32.5 percent, while maintaining the Liquidity Ratio at 30 percent.

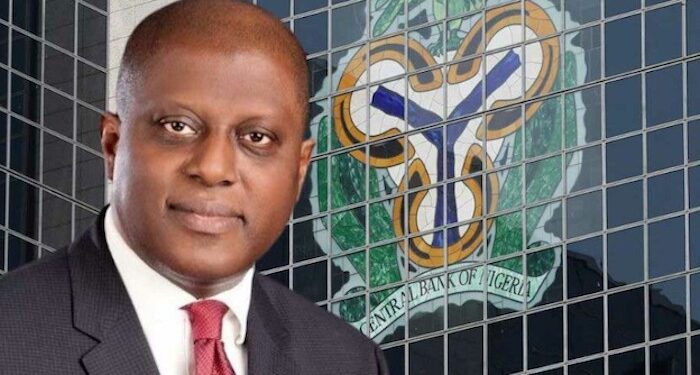

Olayemi Cardoso, the CBN governor, emphasized the necessity of these measures to address inflationary pressures effectively. The rate hike is intended to curb inflation substantially, as inflation stood at 29.90 percent in January.

Cardoso also highlighted the recent disbursement of $400 million to settle part of the outstanding foreign exchange commitments, targeting genuine requests. Additionally, he defended the CBN’s crackdown on cryptocurrency platforms, citing concerns over illicit flows and suspicious transactions, particularly on Binance.

The MPC’s decisions were driven by current inflationary and exchange rate challenges, with a focus on projected inflation and rising inflation expectations. The committee recognized the trade-off between pursuing output growth and containing inflation, ultimately prioritizing low and stable inflation for sustainable economic expansion.

Despite the aggressive monetary policy stance, concerns have been raised regarding its impact on the real sector of the economy. Dr. Muda Yusuf of the Centre for the Promotion of Private Enterprise (CPPE) warned that the rate hike and CRR increase could hinder economic growth and investment, particularly in the real sector.

Yusuf highlighted the need for policy responses tailored to Nigeria’s economic peculiarities, emphasizing supply-side issues as primary drivers of inflation. He stressed the importance of addressing constraints on bank lending and promoting financial intermediation to stimulate economic activity effectively.

The CBN’s actions reflect a proactive approach to tackling inflation and stabilizing the economy. However, balancing the need for price stability with supporting economic growth remains a key challenge amidst evolving domestic and global economic conditions.